arizona solar tax credit form

To take advantage of these tax exemptions a solar energy retailer must register with the Arizona Department of Revenue prior to selling or installing solar energy devices Arizona Form 6015 Solar Energy Devices Application for Registration The exemption for solar energy retailers has no expiration date. Phoenix AZHomeowners who installed a solar energy device in their residential home during 2021 are advised to submit Form 310 Credit for Solar Energy Devices with their individual income tax return and Form 301 Nonrefundable Individual Tax Credits and Recapture.

Aurora Guide How The Northern Lights Work Infographic Space And Astronomy Earth And Space Science Astronomy

Claiming the federal ITC involves determining your tax appetite and filling out the proper forms.

. Residential Arizona solar tax credit. Their tax credit incentive will let you deduct 25 of the cost of your solar energy system from your state income taxes. If you have any further questions regarding taxes consult a tax professional.

Or Form 140X box 40a. 32 Family Income Tax Credit from Form 140 line 50. For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y.

This credit offers 25 off the gross cost of the system up to a maximum credit of 1000. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. The Consolidated Appropriations Act of 2021 bill.

This information is provided as general knowledge. Some users have reported that even though they do not choose the solar energy credit for Arizona in the state review they are asked to fill some fields for form 310 Solar Energy Credit. Equipment and property tax exemptions.

Form 344 is an Arizona Corporate Income Tax form. Some common tax credits apply to many taxpayers. For the calendar year 2019 or fiscal year beginning M M D D 2 0 1 9 and ending M M D D Y Y Y Y.

Arizona state tax credit for solar. Credit for Solar Hot Water Heating Plumbing Stub Outs and Electric Vehicle Recharge Outlets Arizona Form 319 Arizona Form 319 Credit for Solar Hot Water Heater Plumbing Stub Outs and Electric Vehicle Recharge Outlets 2019 Include with your return. Arizona Form 310 Arizona Form 2021 Credit for Solar Energy Devices 310 Include with your return.

Part-Year Resident Personal Income Tax Return Non-calculating fillable Part-Year Resident Personal Income Tax Return. Or Form 140PY line 60. Your Name as shown on Form 140 140PY or 140X Your Social Security Number Spouses Name as shown on Form 140 140PY or 140X if a joint return.

A solar energy device is a system or series of mechanisms which collect and transfer solar. This fillable is for taxpayers who need a plain fillable Form 140PY or are filing Arizona Small Business Income Tax Return Form 140PY-SBI and needing to enter the amount from Form 140PY-SBI. Arizona just like the federal government is offering an income tax credit for switching to a solar energy system.

To claim the solar tax credit youll need to first determine if youre eligible then complete IRS form 5695 and finally add your renewable energy tax credit information to Schedule 3 and Form 1040. States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar reduction of tax liability. The most significant solar rebate offered in Arizona is the Credit for Solar Energy Devices from the Arizona Department of Revenue.

A taxpayer is eligible for the credit only for a solar energy device installed in the taxpayers residence located in Arizona. The Residential Renewable Energy Tax Credit is a Federal personal tax credit. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation.

The Renewable Energy Production tax credit is for a qualified energy generator that has at least 5 megawatts generating capacity and is not for a residential application. If your federal tax liability is lower than the total amount of your ITC savings you can still take advantage of it by carrying over any remaining credits to the following year. The Arizona tax credit for solar panels is 25 of your system costs or 1000 whichever amount is less.

It is a 25 tax credit on product and installation for both 2020 and 2021. May a taxpayer who rents take the solar energy credit for a solar energy device installed on his or her rented residence. Arizona Credit for Solar Hot Water Heater Plumbing Stub Out and Electric Vehicle Charging Station Outlet.

Download or print the 2021 Arizona Credit For Solar Energy Credit 2021 and other income tax forms from the Arizona Department of Revenue. Arizona has the Arizona Solar Tax Credit. The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies Wind Fuel Cells Geothermal and Heat Pumps.

Theres no cap on the federal tax credit and it can be claimed over multiple years if necessary. The tax credit amount was 30 percent up to January 1 2020. However a TurboTax user has come up with a workaround.

This incentive comes right off of your income tax for the same year you install the solar system. Form 309 3 00 4 Credit for Solar Energy Devices. No preapproval is required for an individual income tax credit for a residential Solar Energy Device tax credit that is claimed on Form 310.

Neither Solar Concepts Redilight QuietCool or any product manufacturers are tax consultants. For contributions that exceed the maximum allowable credit on Arizona Form 323 Form 348. According to our market research and data from top solar brands the average cost of solar panels in Arizona is 261 per watt of solar capacity which means a 5-kW system costs around 13050 before incentives.

We have not been able to reproduce this issue. This is a personal solar tax credit that reimburses you 5 of the cost of your solar panels up to 10001000 maximum credit per residence irrespective of the number of energy devices installed. Arizona solar tax credit.

Residential Arizona Solar Tax Credit. Thanks to the Solar Equipment Sales Tax Exemption you are free from the burden. That is a nice bonus to add to the 26 Federal Solar Tax Credit.

Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward State income taxes. The federal ITC remains at 26 for 2022. However unlike the federal governments tax credit incentive Arizona tax credits have a limit.

This 75 credit is provided for in Arizona Revised Statutes 43-1090 and 43-1176 and is a nonrefundable individual and corporate income tax credits for the installation of solar hot water heater plumbing stub outs and electric vehicle recharge outlets in houses or. Arizona Residential Solar Energy Tax Credit Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year. A taxpayer is eligible for the credit for a solar energy device which.

Phoenix Arizona Water Bill Utility Statement Custom Template Purchase Proof Of Address Bill Template Water Bill Bills

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Pin By Jason Ritter On Quick Saves Internal Revenue Service Tax Forms Fillable Forms

New Energy Score Policy The Scoop On Solar Required Home Energy Assessment Prior To Sale That Has To Be Shared Wit Real Estate Tips Energy Consumption Energy

Resonance And Morphogenesis As Carbon Water Clusters Fit Together To Form Cells Organs And Bodies Life Assumes A Ran Energy Smoothies Green Energy Organs

How To Find My W2 Form Online With H R Block Hr Block Filing Taxes Employer Identification Number

How Solar Energy Works With An Inverter Organizingmadefun Com How Solar Energy Works Solar Panel Installation Solar Water Heating

How To Fill Out Atf Form 1 Employer Identification Number Form Filling

Solar Energy With Sunset Glow Solar Energy Panels Solar Solar Installation

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms W2 Forms Income Tax

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

New Energy Score Policy The Scoop On Solar Required Home Energy Assessment Prior To Sale That Has To Be Shared Wit Real Estate Tips Energy Consumption Energy

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

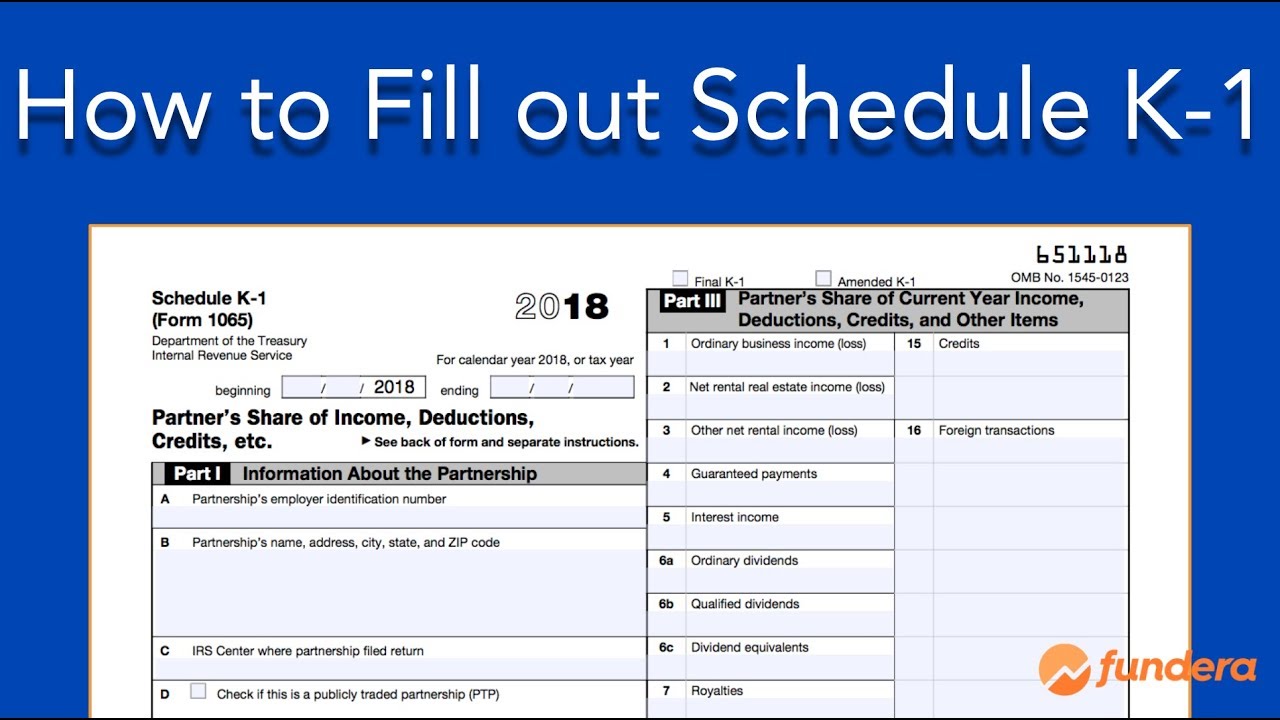

How To Fill Out Schedule K 1 Irs Form 1065 Youtube